Question:

Why do you require a utility token to run on the velocity network?

Answer:

To really answer this question, we first need to go back in history and explore the early days of the internet.

The Internet is the ‘Great Transformer’ of our times. It enables global network interoperability and interconnectivity and changed every aspect in our daily lives, fundamentally transforming the way we work, socialise, create and share information, and organise the flow of people, ideas and things.

Alas, the pioneering scientists, programmers and engineers that developed the new features and technologies that eventually merged to become the Internet we know today, would probably not like what it has become.

The internet was meant to be a great equalizer. What its brilliant masterminds envisioned was a tool that would make it possible for everyone, everywhere to share knowledge, opinions, and ideas. To allow small publishers to reach new audiences in ways that had been impossible before. To connect people across distances, cultures, and continents.

Their plan was terrific. But there was a catch: how would they fund all this?

Compensating authors and builders of applications required a system to process micropayments, whereby readers would pay for each page, article or post. The problem was that existing payment processing had high transaction costs. Credit card companies and other payment processors like PayPal suffer from the same problem: high transaction costs, which make micropayments unfeasible.

The lack of a seamless, frictionless micropayment system is a central flaw in today’s internet. And we’re paying dearly, with a laundry list of issues.

Instead of digital micropayments, the internet ended up with advertising as a business model. For ads to be effective, relevant, and targeted, advertising companies needed as much information about users as possible. That’s how the internet morphed into an intrusive consumer surveillance tool it is today, exploiting people’s personal information.

Not even the man who invented pop-up internet ads likes them. Professor Ethan Zuckerman publicly apologized in 2014, via an article in The Atlantic. He describes how their intentions were good and expresses remorse for what he calls the “original sin” of the internet. Digital payments were supposed to be an integral part of the internet.

The mental model the underpins Velocity Network is very similar to the Internet – a public, open, inclusive utility layer that enables trusted exchange of verifiable education and career credentials. The Internet of Careers®.

Right from the start, our vision for its open, collaborative ecosystem was clear. Its ubiquity and global adoption were driven by the ability of independent builders and the incumbents of the ed tech and workforce tech markets, to build clear, straightforward business cases for issuing and verifying credentials. Our goal of innovative use cases and services would only be achieved if we facilitated an incentive system and monetization framework that reward entrepreneurs and investors.

Twenty-five years of pop-up ads have clearly shown us how not to go about this. We know better than to use the old ads-based business model. This is our chance to get it right, this time around.

Embedding frictionless, digital-native, low-cost payment rails that allow participants to pay for value and services easily and cost-effectively on the Internet of Careers® is one of its key design principles.

This payment system is the Velocity Credit Utility Token.

The Velocity Network uses a native currency within the ecosystem. The Velocity Credit Utility Token is the essential element that powers the Velocity Network ecosystem.

Question:

How does the Network’s monetary system work?

Answer:

The use of the career wallet app is free for the Holder. Claiming credentials is free. Sharing credentials is free.

Upon network genesis, a finite number of Velocity Credit Tokens was issued by the Velocity Network Foundation, the governing entity of the Network, and moved to its reserve. Moving forward, minting new tokens will only be applicable in the unlikely event that the Velocity Network Foundation runs out of tokens and is no longer capable to fund the operation of the network. Minting additional tokens requires special unanimous resolution of the Foundation’s elected board.

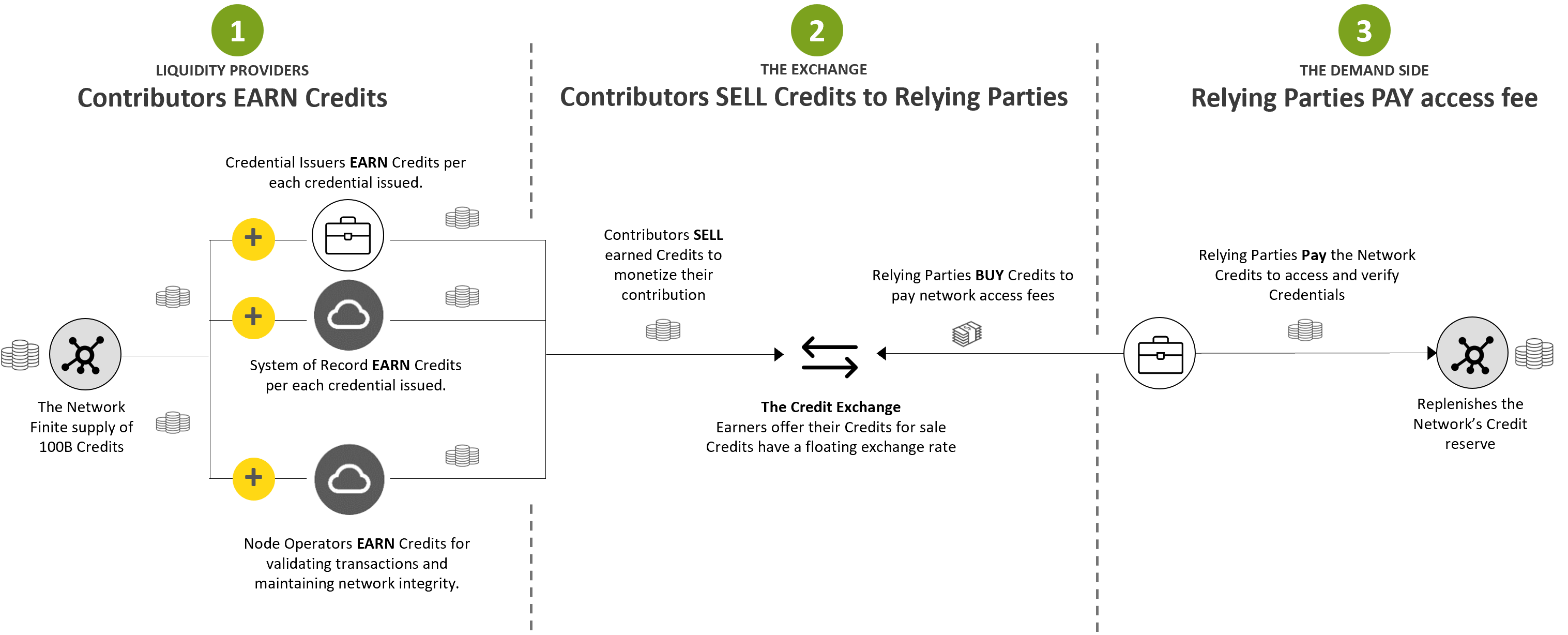

Contributors to the Network (i.e., Issuers of credentials and their data processors and Node Operators) are rewarded for their contribution:

Issuers earn Velocity Credits for every credential they issue to their constituents. The Credential Agent Operator used to issue the credential is earns Credits.

The Credit reward is given immediately upon issuing, regardless of whether the credentials are used by the individual or not.

Node Operators are rewarded periodically, again with Credits, for running the decentralized infrastructure, validating transactions, and maintaining network integrity.

Relying Parties pay fees to access the blockchain and verify credentials shared with them by individuals. Access fees are paid in the same native currency – Velocity Credits.

Now we have demand for Credits coming from relying parties. They are in need for this asset to pay their fees for verifying credentials and willing to pay for it as long as the price of this asset represents reasonable transaction fee for the Verification.

This demand creates a market for the earners of Credits to sell their reward and redeem it for cash. This transaction takes place on the internal Credit marketplace operated on the network.

Relying parties buy credits and pay cash. Earners sell earned credits and get cash in return. This is a low cost, native value transfer mechanism that enables participants to monetize their contribution.

Sellers on the exchange can ask any price they choose for their credits and the buyers decide from which seller they will buy. Since there are many sellers and many buyers what we get is a competitive marketplace where the price point of the Credit is set by flow demand and supply. As the demand for network services grows, the Credit price will probably appreciate and vice versa.

By the way, in many cases, Relying Parties are also issuers of credentials (take employers for example) and Credits they have earned as Issuers can be used to pay for their access fees, offsetting their verification costs.

Question:

How is the price for using the Network to verify someone’s credentials is being set?

Answer:

Individuals holding credentials respond to a disclosure request from relying parties and share a select set of their credentials. This set of credentials, shared on a single disclosure is call a Presentation.

A Relying Party looking to access the blockchain to verify a Presentation shared by an individual pay access fees. The access fee is quoted in Velocity Credits and is fixed per the transaction of verifying a person’s Presentation. This means that the Doller cost of the transaction depends on the Credit price at any given time. Changes in the price of the Credit will change the price of the transaction quoted in Credits.

Actually, this works the other direction. It is not the price of the Credits that sets the price of the transaction but rather the other way around. It is the price that Relying Parties are willing to pay for the transaction that will set the price of the Credits. Since the demand curve for the transaction is represented in Dollars and not in Credits, this is practically the mechanism that sets the demand curve for the Credits. If the credit price appreciates to a level that makes the cost to use the Network to verify someone’s credentials too high for the Relying Parties, they will move to use other alternatives. We will see the demand for the Network services depreciates and consequently effects the demand for Credits at this price point, pushing their price down.

Question:

Why was Velocity Career Labs given a large grant of Credits at the Network’s genesis?

Answer:

As the developer of Velocity Network, Velocity Career Labs invested dozens of millions of dollars in building the tech stack and the underlying protocols that runs it. To enable the company and its investors return on this investment the company received a considerable grant of Credits that were transferred to its wallet as reward for developing and deploying the Network and to incentivize the company to continuedly support network development, operate as a market maker, help bootstrap adoption etc. These credits will only have value if the Network becomes ubiquities and successful, creating continued incentivization for Velocity Career Labs to continue investing in the development of the Network and its underlying protocols.

Question:

The Velocity Credit token is essentially asset traded for cash. When you deal with trading assets there is always the risk of speculative trading that disconnects the price of the asset from the value of its utility. How have you dealt with this in the design of the system?

Answer:

The limited-supply token is indeed a de-facto store of transaction value, but it also can lead to speculation and volatility. Speculative trading will occur when actors buy credits not for using them but because they believe their price will appreciate in the future and they will be able to sell it back to the market for a profit.

This is not good. Since the Velocity Credit token is a utility token used to pay for verifications. The price of the Credit should be set by the utility value to the Relying Parties (at any given time) of the verification of credentials it enables. In addition, speculative trading is usually characterized with High volatility in credit price. Organizations that participate as Relying Parties usually run on annual budgets and do not like price volatility.

To maintain ecosystem efficiencies, we needed to create a situation in which the Credit price reflects the current transaction value to the market at any given time and not subject to speculations for the purpose of financial gain.

Two mechanisms are put in place to prevent speculation:

First, Credits can only be held and traded between network participants, all of whom labor market stakeholders. Financial players are not permitted. The Velocity Credit tokens are also not traded outside the network. Users cannot transfer Credits amongst themselves if not via the internal exchange. This takes pure financial players out of the equation.

Second, Network participants can buy Credits only if you are spending them immediately to access the blockchain and verify credentials. You can store earned Credits but not buy Credits as an investment and speculation instrument.

Credit price is therefore set only by balancing demand and supply and in accordance with the value of verification transaction to the Relying Parties.

Question:

Relying Parties looking to use the Network to verify a Presentation shared by an individual would need to buy Credits to pay access fees.

What happens if no one is currently selling Credits on the market?

Answer:

Since the Velocity Credit token is a utility token, instant liquidity is mandatory to sustain network efficiencies. In any given time, if a Relying Party is asking to buy Credits in order to pay for verifications, there must be a corresponding supply of these tokens in the market. To serve this purpose the Velocity Network Foundation has certified Market Makers that will fulfil any demand on the exchanges.

The Foundation will also sell tokens into a spiking market to avoid counterproductive volatility of token price.

During the initial period of operations, we can expect that the majority of liquidity will be offered by market makers. During that period additional actors will accumulate token reward until the system will reach a tipping point, where these earners will overtake the market makers as the major token liquidity provider on the internal exchange. When the shift occurs, the monetary system will behave like any free market.

Question:

Who governs this monetary system, making sure it works well?

Answer:

Running a Network economy is similar to running a small economy. Without adequate monetary and fiscal policies, you might be setting up for failure down the road.

In order to develop the necessary monetary and fiscal practices of the Velocity Network, we have simulated various market scenarios and believe that these practices will lead the Network to a healthy economic balance. Nevertheless, if any of the assumptions taken into the calculations prove wrong, the board of the Foundation has the authority to amend and introduce changes to monetary and fiscal processes that will rectify and course-correct the system toward regaining its healthy balance.

The bar to introducing changes to the monetary and fiscal policies was set very high. Such changes are subject to a unanimous vote by the Foundation’s elected board of directors thus ensuring that no single entity, regardless of size or industry impact, will have the ability to make unilateral changes or sway the tokenomics model to their own benefit.

Photo by Dan Dennis on Unsplash